vermont income tax withholding

New York City. To help employers determine which payments are subject to Vermont income tax withholding and how much to withhold from an.

Vermont Income Tax Vt State Tax Calculator Community Tax

871 a and 881 a impose a tax of 30 of the fixed and determinable annual or periodical FDAP income received from sources within the United.

. This property tax credit is only available on certain years - it has been suspended by the New. An employer is required to withhold Vermont income tax. The income tax withholding for the State of Vermont includes the following changes.

You must pay estimated income tax if you are self employed or do not pay. All taxpayers Semiweekly Monthly and Quarterly are now required to file Form WHT-434 Annual Withholding Reconciliation due the last day of January. The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022.

When you start a new job your employer will ask you to complete a federal Form W-4 the Employees Withholding Allowance Certificate and a Form W-4VT for Vermont withholding. Vermont income tax rate. The Vermont Department of Taxes issued updated guidance concerning the income tax rules that apply to employees who work remotely or who are temporarily relocated to the state due.

Census Bureau Number of cities with local income taxes. 2022 New Jersey Tax Tables with 2023 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Since a composite return is a combination of various.

New Jersey has a graduated Income Tax rate which means it imposes a higher tax rate the higher the income. This form serves as the. Form NJ-1040-H is a property tax credit application available to certain home-owners and tenants.

The annual amount per allowance has changed from 4400 to 4500. If you want even more control over. Compare your take home after tax and estimate.

State Reports Strong Tax Revenue Results For March Vermont Business Magazine

Strength In Personal Income Leads Tax Revenue Results Vermont Business Magazine

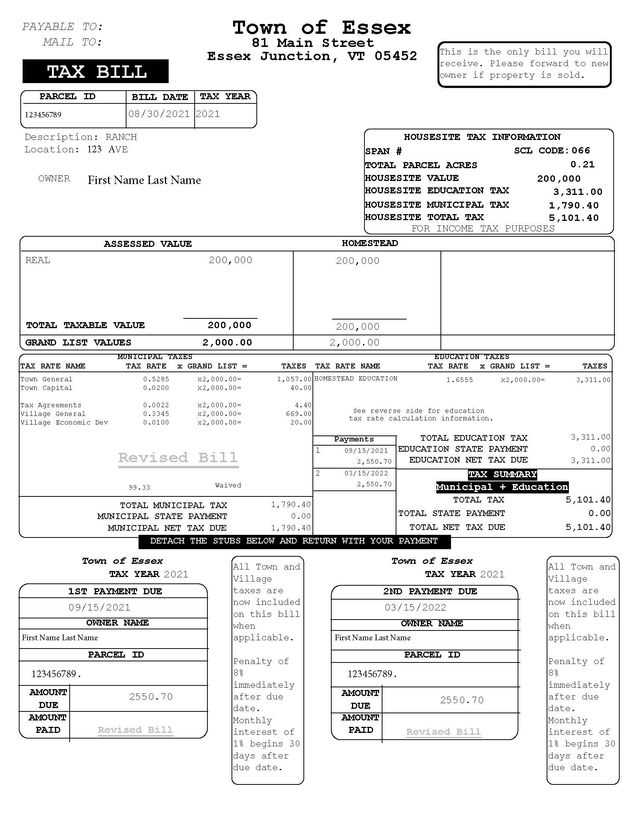

Real Estate Taxes Burlington Vt Peet Law Group

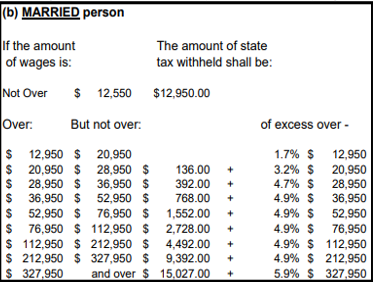

State Withholding Tax Table Maintenance Vermont W Hx03

Hiring Out Of State Employees In Vermont

States That Tax Social Security Benefits Tax Foundation

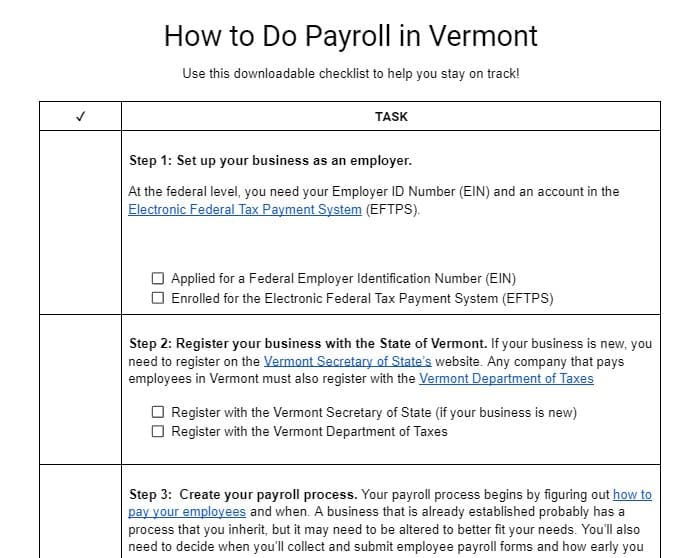

How To Do Payroll In Vermont What Every Employer Needs To Know

Where S My State Refund Track Your Refund In Every State

Vt Dept Of Taxes Vtdepttaxes Twitter

Vt Dept Of Taxes Vtdepttaxes Twitter

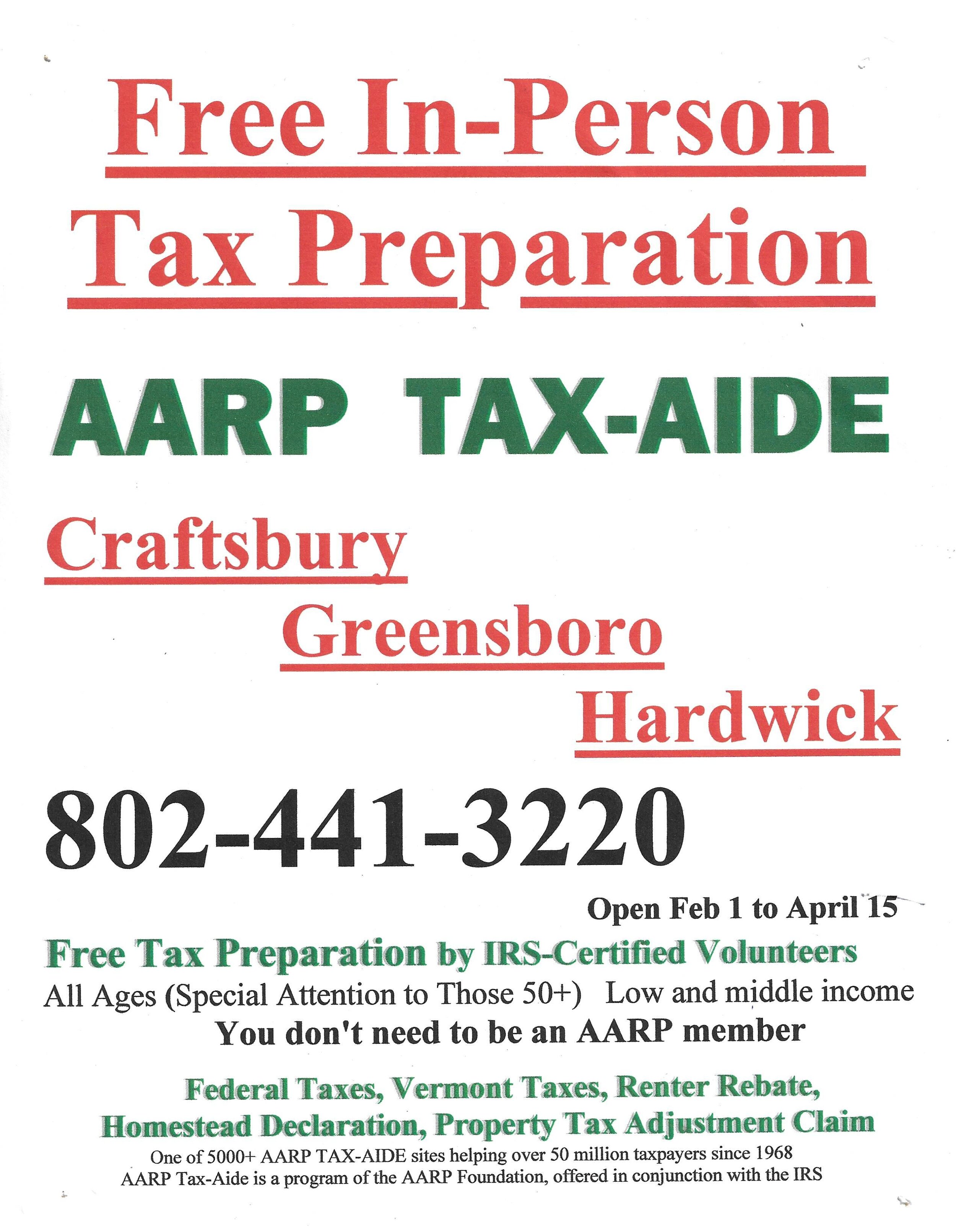

Vermont Tax Information Town Of Craftsbury

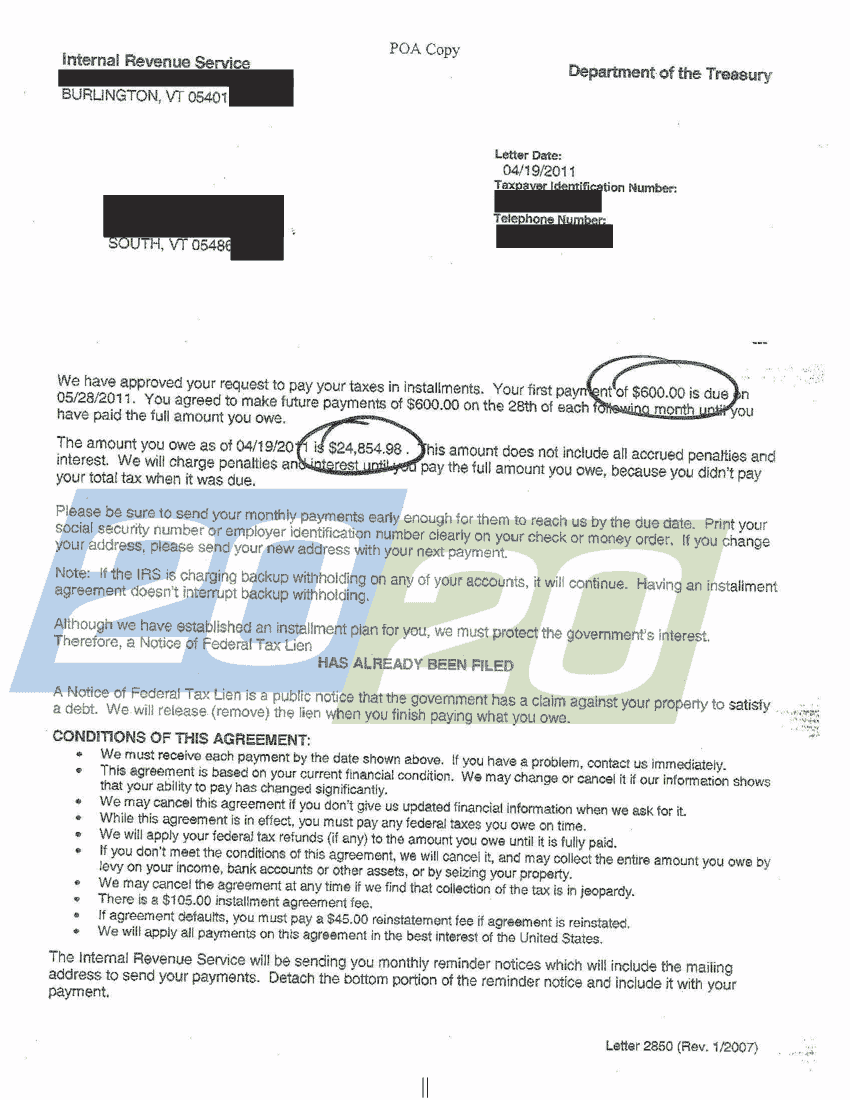

Successful Tax Resolutions In Vermont 20 20 Tax Resolution

State Withholding Tax Table Maintenance Vermont W Hx03