salt tax cap news

12There has been a lot of discussion amongst government leaders about the cap on state and local tax SALT deductions. I provide a newsletter monthly here on my site and via email so you can stay in touch with changing regulation.

House Democrat Plan Bumps State And Local Tax Cap To 80 000 Till 2030

Tom Suozzi D-NY speaks during a news conference announcing the State and Local Taxes SALT Caucus outside the US.

. Web November 22 2022. Assume your maximum income tax rate is 246 percentthe current average for that. Web Stay current with recent tax changes news and financial tips.

Taxpayers can deduct up. Web The states 2018 analysis showed 752000 Californians earning less than 250000 a year paid an additional 1 billion in federal taxes thanks to the SALT cap. Web Each of their California state tax bills would have dropped from 665000 to just 200000.

We have also provided you with online resources to assist you in the. The Biden Administrations Build. How To Avoid Overpaying Taxes Via A SALT CAP Strategy.

In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep. Web On this website you will find information about Massood Company PA CPAs including our list of services. Web In The News.

Web The 10000 limit applies to both single and married filing jointly filers. Second the 2017 law capped the SALT deduction at 10000 5000. Web The SALT deduction benefits only a shrinking minority of taxpayers.

Before the creation of a cap on this deduction 91 of the. Web The nonpartisan Tax Policy Center found that if the SALT cap were to be repealed entirely 70 percent of the benefits would go to people with annual incomes. Salt rooms began to be created with salt rock and the invention of the salt generator came about.

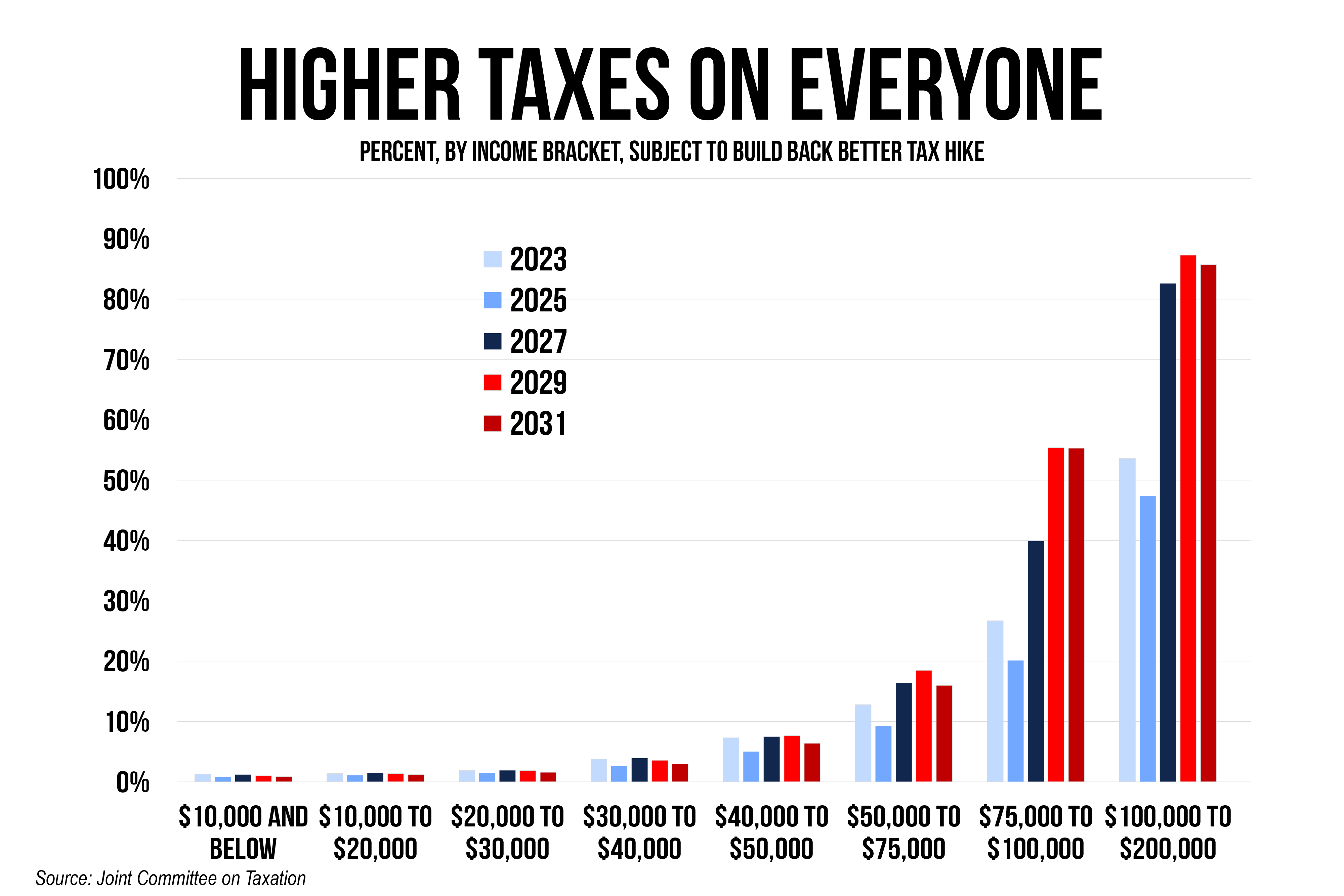

The cap is reduced to 5000 for filers who are married filing separately. Web The current Democrat-controlled House passed a bill in 2021 that would temporarily raise the cap to 80000 until 2031 when it would go back to 10000. Web The SALT Cap only allows you to deduct 10000 of those payments.

Capitol on April 15 2021. Web The state and local tax deduction cap commonly known as SALT was enacted as part of President Donald Trumps 2017 tax reforms. The overall tax liability for each partner would drop from around 25.

Web But you must itemize in order to deduct state and local taxes on your federal income tax return. Web The SALT deduction applies to property sales or income taxes already paid to state and local governments. WAYNE NJ Approximately 546 million people will travel 50 miles or more from home this Thanksgiving a 15 increase over 2021 and.

Web As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already. Web Salt rock was mined from underground and a new technique was developed.

Georgia S Pass Through Entity Tax Election Offers Salt Cap Workaround Mauldin Jenkins

Goldstein Often Overlooked Tax Savings Opportunity The Salt Cap Workaround Long Island Business News

How Raising The Salt Deduction Limit To 80 000 May Affect Your Taxes

Millionaire Sounds Off On Calls To Lift Salt Deduction Cap Itep

Salt Cap Workaround Pass Through Entity Tax Update Part I

The Price We Pay For Capping The Salt Deduction Tax Policy Center

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Tax Fight Democrats Want Salt Cap Gone In Biden S Big Spending Plans

Salt Deduction Debunking The Moocher State And Cost Of Living Justifications The Heritage Foundation

What Salt Tax Cap Repeal Could Mean For Florida S Migration Momentum Tampa Bay Business Journal

Ahead Of Year End Tax Package Negotiations Gottheimer Releases Report Highlighting Rising Nj Taxes And Lower Home Values Due To Salt Cap Calls On Congress To Reinstate Salt Deduction By Year S End Focuses

Icymi Gottheimer Souzzi Discuss Reinstating Salt Deduction With Usa Today U S Representative Josh Gottheimer

Ranking Member S News Newsroom The United States Senate Committee On Finance

The Politics Of The Salt Cap Isn T Red Vs Blue Wsj

Salt Deduction Disliked On Both Sides May Live Another Day As Congress Debates 1 75 Trillion Social Spending Bill Marketwatch

Democrats Consider Salt Relief For State And Local Tax Deductions

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Coping With The Salt Tax Deduction Cap

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress