vermont state tax withholding

Restaurants In Matthews Nc That Deliver. How to Calculate 2019 Vermont State Income Tax by Using State Income Tax Table.

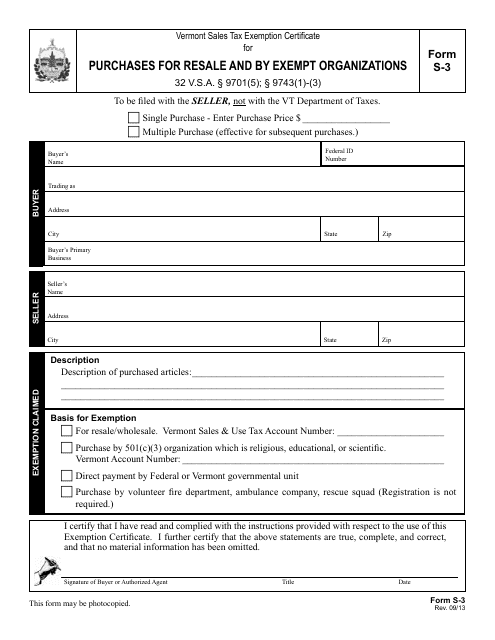

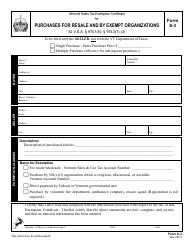

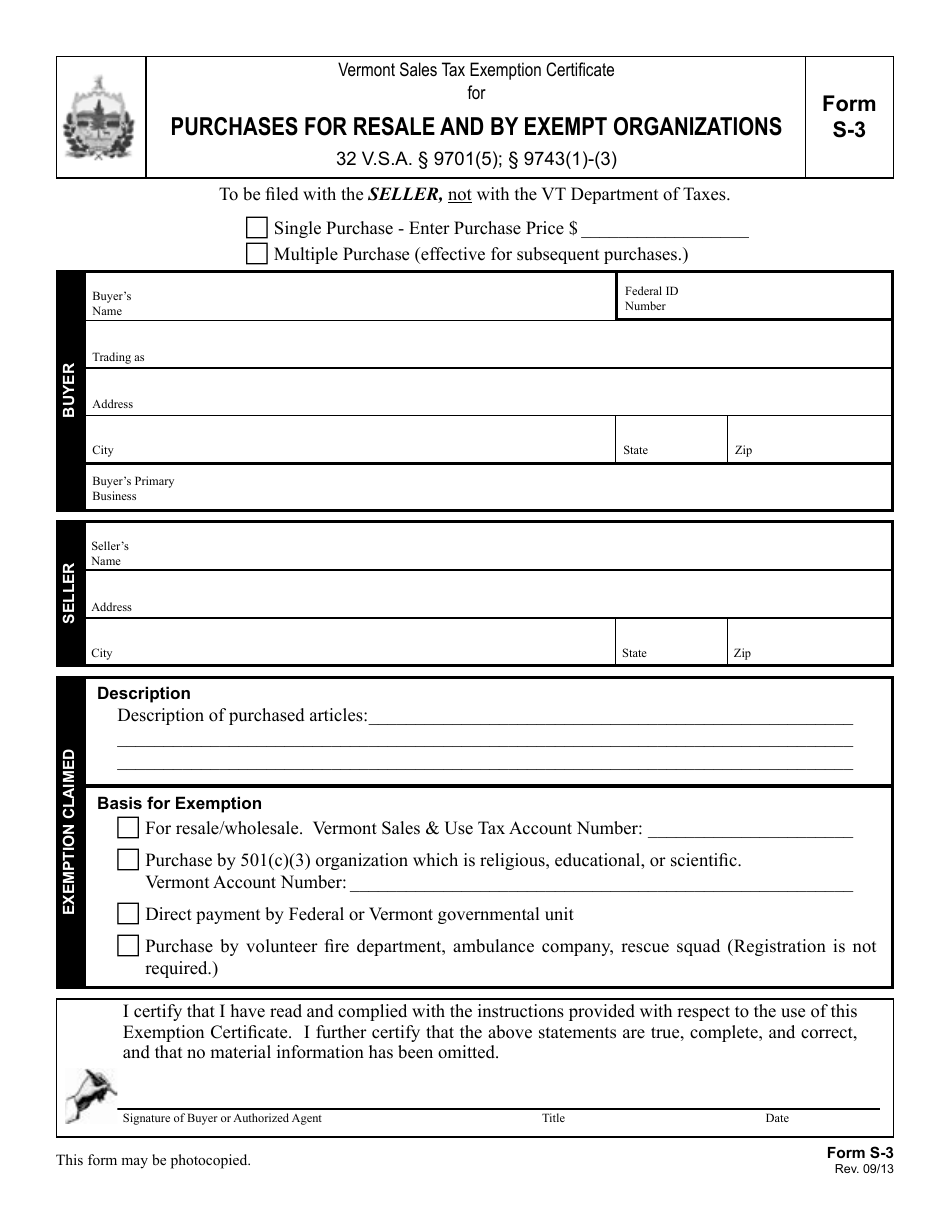

Vt Form S 3 Download Printable Pdf Or Fill Online Purchases For Resale And By Exempt Organizations Vermont Templateroller

Other payments are generally subject to vermont income tax withholding if the payments are subject to federal tax withholding and the payments are made to.

. Check the 2019 Vermont state tax rate and the rules to calculate state income tax. Once the employer has the information youve entered on forms W-4 and W-4VT the employer is able to calculate your withholding tax. Sign Up for myVTax.

The policy behind this tax is to allow the state to grab a portion of the sellers proceeds before they leave. Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding. The Single Head of Household and Married tax tables has changed.

Plan the correct withholding rate is 6 of the deferred payment. No action on the part of the employee or the personnel office is necessary. How to File For Buyers.

If the seller is a nonresident the buyer is required to withhold 25 of the sale price and remit it to the Vermont Department of Taxes. If you pay wages or make payments to Vermont income. The state tax is payable on the first 15500 in wages paid to each employee during a calendar year.

If Federal exemptions were used and there are additional withholdings proceed to step 8. If additional Federal tax was withheld multiply the additional amount by 26 percent and add that to the result of step 7 to obtain the biweekly Vermont tax withholding. Overview of Vermont Taxes.

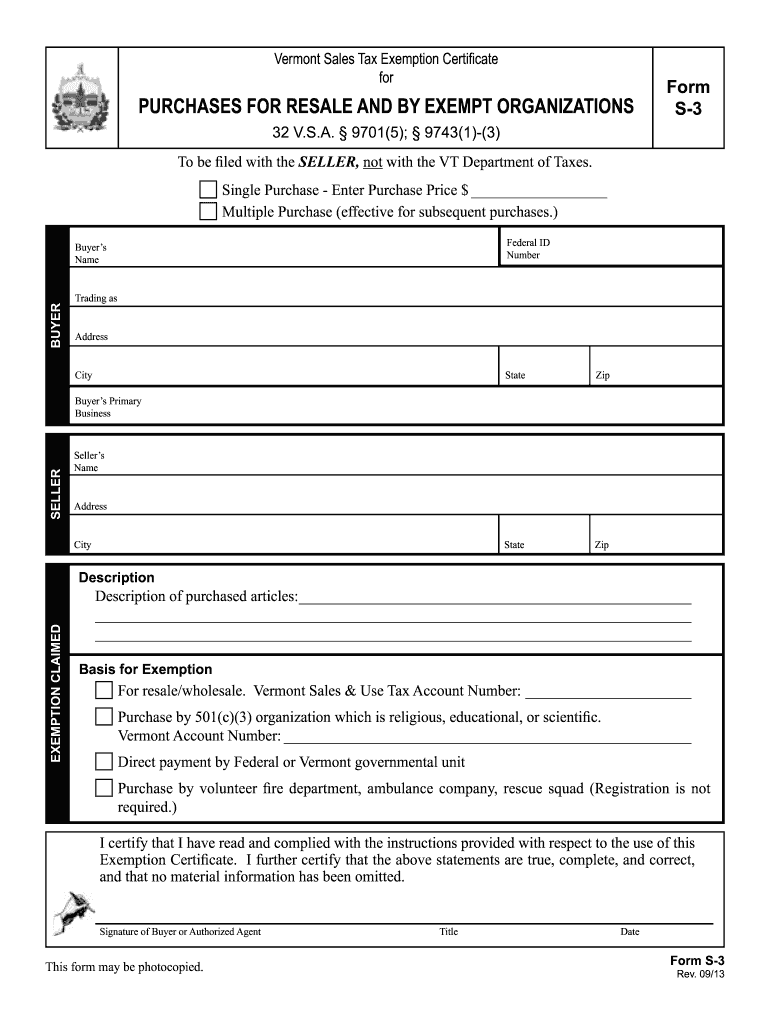

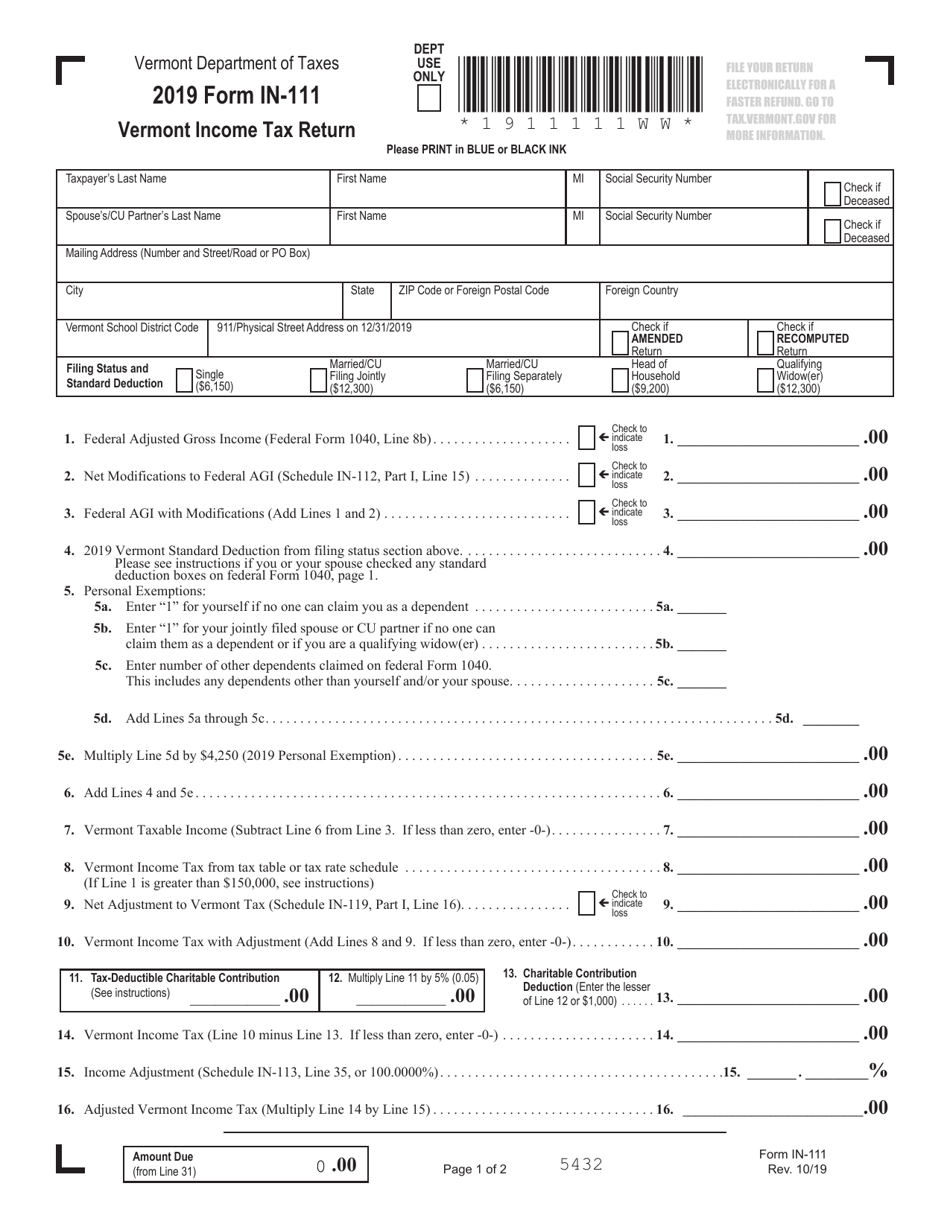

Before sharing sensitive information make sure youre on a state government site. IN-111 Vermont Income Tax Return. State government websites often end in gov or mil.

Find your pretax deductions including 401K flexible account contributions. If additional Federal tax was withheld multiply the additional amount by 26 percent and add that to the result of step 7 to obtain the biweekly Vermont tax withholding. When real estate is sold in Vermont state income tax is due on the gain from the sale whether the seller is a resident part-year resident or nonresident.

W-4VT Employees Withholding Allowance Certificate. PA-1 Special Power of Attorney. 511 - Road Travel Info.

It is important to update your W-4 and W-4VT annually and whenever your filing status or number of allowances change. When you receive your payeither by direct deposit or paper. The amount of the tax is 25 of the gross sale price eg with a contract sale price of 25000000 the withholding tax is 625000.

The more you withhold the more frequently youll need to make. The withholding is based on both the deferred payment and any income that may be derived from the deferred compensation. The instructions on Vermonts Form W-4VT will guide you through the process in Vermont.

Find your gross income. In Vermont sellers of real property who are not residents of the state are subject to a real estate withholding tax collected at the time of closing. If you want even more control over your tax withholding you can also specify a dollar amount for your employer to withhold.

Up to 25 cash back File Scheduled Withholding Tax Payments and Returns. For example if you want your employer. Essex Ct Pizza Restaurants.

Vermont nonresident income tax requirements. No action on the part of the employee or the personnel office is necessary. As an employer in Vermont you have to pay unemployment insurance to the state.

State and Federal Unemployment Taxes. In Vermont there are three main payment schedules for withholding taxes. If your state tax witholdings are greater then the amount of income tax you owe the state of Vermont you will receive an income tax refund check from the government to make up the difference.

State government websites often end in gov or mil. The IRS provides a Withholding Estimator on its website at irsgov to help you figure out the right amount of federal withholding on Form W-4. Vermont State Tax Withholding.

Income Tax Rate Indonesia. IN-111 Vermont Income Tax Return. The 2022 rates range from 08 to 65 on the first 15500 in wages paid to each employee in a calendar year.

The income tax withholding for the State of Vermont includes the following changes. The income tax withholding formula on supplemental wages for the State of Vermont includes the following changes. Reporting and Remitting Vermont Income Tax Withheld.

PA-1 Special Power of Attorney. 2021 Income Tax Withholding Instructions Tables and Charts - copy. Soldier For Life Fort Campbell.

911 - Emergency Help. Health Alerts and Advisories. Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding.

The states top income tax rate of 875 is one of the highest in the nation. Vermont has a progressive state income tax system with four brackets. If youre a new employer congratulations on getting started rates range from 1 to 48 depending on your industry.

The annual amount per allowance has changed from 4350 to 4400. State unemployment taxes are paid to this Department and deposited into a trust fund that can only be used for the payment of benefits. Vermont School District Codes.

Semiweekly monthly or quarterly. Delivery Spanish Fork Restaurants. If Federal exemptions were used and there are additional withholdings proceed to step 8.

8 rows The income tax withholding for the State of Vermont includes the following changes. The annual amount per exemption has increased from 4050 to 4250. Your payment schedule ultimately will depend on the average amount you withhhold from employee wages over time.

Employers pay two types of unemployment taxes. Opry Mills Breakfast Restaurants. It should take one to three weeks for your refund check to be processed after your income tax return is recieved.

W-4VT Employees Withholding Allowance Certificate. 211 - Social Services Help. Before sharing sensitive information make sure youre on a state government site.

To help employers calculate and withhold the right amount of tax the IRS and the Vermont Department of Taxes issues guides each year that include withholding charts and tables. Vermont State Unemployment Insurance. Find your income exemptions.

The amount of the tax is 25 of the gross sale price eg with a contract sale price of 25000000 the withholding tax is 625000. The Single or Head of Household and Married income tax withholding tables have changed.

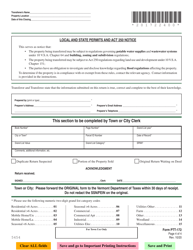

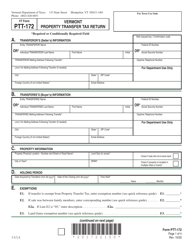

Vt Form Ptt 172 Download Fillable Pdf Or Fill Online Vermont Property Transfer Tax Return Vermont Templateroller

Vt Dot S 3 2013 2022 Fill Out Tax Template Online Us Legal Forms

Form In 111 Download Fillable Pdf Or Fill Online Vermont Income Tax Return 2019 Vermont Templateroller

Ct 3 Cigarette Tax Stamp Order Form

State Withholding And Filing Rules For Nonresident Employees Wolters Kluwer

Vt Form S 3 Download Printable Pdf Or Fill Online Purchases For Resale And By Exempt Organizations Vermont Templateroller

Vt Form Ptt 172 Download Fillable Pdf Or Fill Online Vermont Property Transfer Tax Return Vermont Templateroller

Vermont Department Of Taxes Facebook

Vermont Department Of Taxes Facebook

Vt Form Ptt 172 Download Fillable Pdf Or Fill Online Vermont Property Transfer Tax Return Vermont Templateroller

Form In 111 Download Fillable Pdf Or Fill Online Vermont Income Tax Return 2019 Vermont Templateroller

Vt Form Ptt 172 Download Fillable Pdf Or Fill Online Vermont Property Transfer Tax Return Vermont Templateroller

Vt Form S 3 Download Printable Pdf Or Fill Online Purchases For Resale And By Exempt Organizations Vermont Templateroller