how much is capital gains tax in florida on stocks

Florida does not assess a state income tax and as such does not assess a state capital gains tax. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

The States With The Highest Capital Gains Tax Rates The Motley Fool

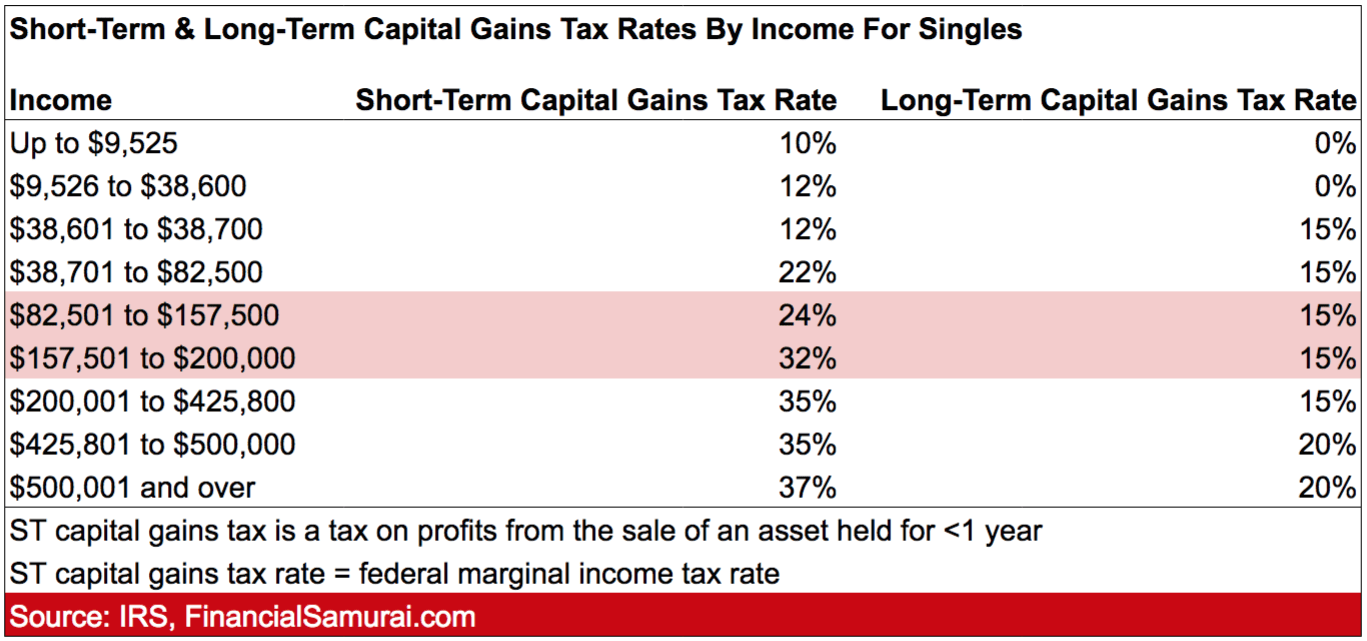

Capital gains can be short-term where the asset is sold in 1 year or less or it can be long-term capital gain where the asset is sold after 1 year.

. The 0 rate applies only to the extent you are below the. Our capital gains tax calculator determines the total tax that you will have to pay on the profit or capital gain you earned from selling an asset. For example if a person earns 50000 per year and earns a capital gain of 1000 they will have to pay 150 in capital gains taxes to the irs.

Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules. Just enter the info from your form as it appears and well calculate everything for you. Held for 1 year or less Short-term capital gains.

Six months later the price of the stock rises to 65 per share. Income over 40400 single80800 married. Special Real Estate Exemptions for Capital Gains.

You can use tax software to get your gains and losses. Hawaiis capital gains tax rate is 725. There may be a bracketed system where the rate is higher as the dollar value of the capital gains go up or there may be a flat tax rate for all long-term capital gains.

You can deduct your losses. Capital Gains Taxes on Property. Ad Need Help Paying Capital Gains Taxes.

You have lived in the home as your principal residence for two out of the last five years. 250000 if married filing jointly or a. As with other assets such as stocks capital gains on a home are equal to the difference between the sale price and the sellers basis.

Income over 445850501600 married. Youll pay taxes on your ordinary income first and then pay a 0 capital gains rate on the first 33350 in gains because that portion of your total income is below 83350. The long-term capital gains tax rate is typically 0 15 or 20 depending on your tax bracket.

Weve Got You Covered. Florida Capital Gains Taxes. If you held your stock for one year or less itll be taxed at the short-term capital gains tax rates of 10 12 22 24 32 35 or 37 depending on your income.

That applies to both long- and short-term capital gains. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap. There is currently a bill that if passed would increase the.

The 1500 gain represents a capital gain. The remaining 66650. Our capital gains tax calculator determines the total tax that you will have to pay on the profit or capital gain you earned from selling an asset.

If you own a home you may be wondering how the government taxes profits from home sales. Unlike the long-term capital gains tax rate there is no 0 percent rate or 20. Ncome up to 40400 single80800 married.

Total Capital Gains Tax. The tax brackets for each province vary so you may be paying different amounts of capital gain tax depending on which province you live in. This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains tax.

Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet the following criteria. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. Your basis in your home is what you paid for it plus closing costs and non-decorative.

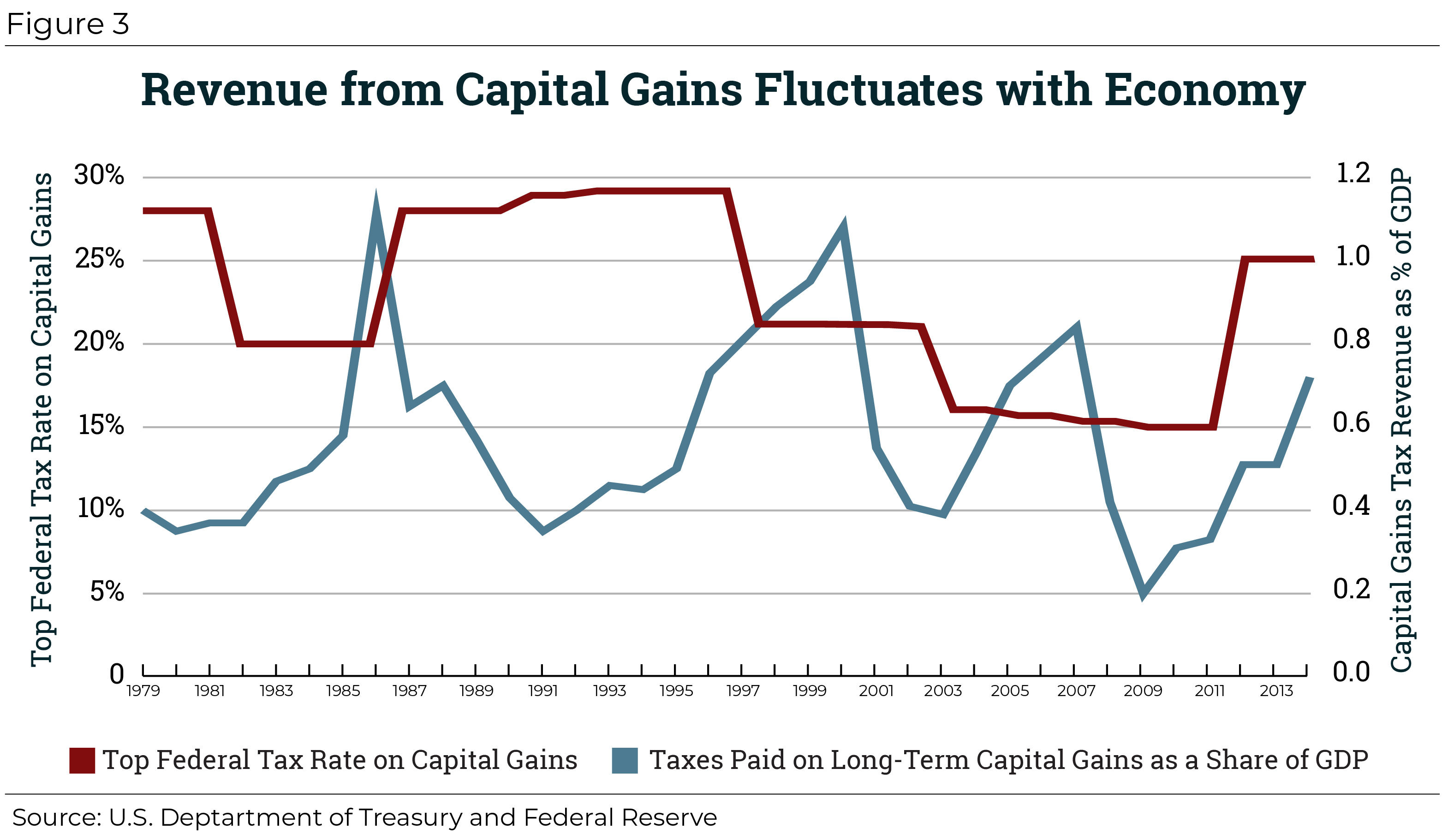

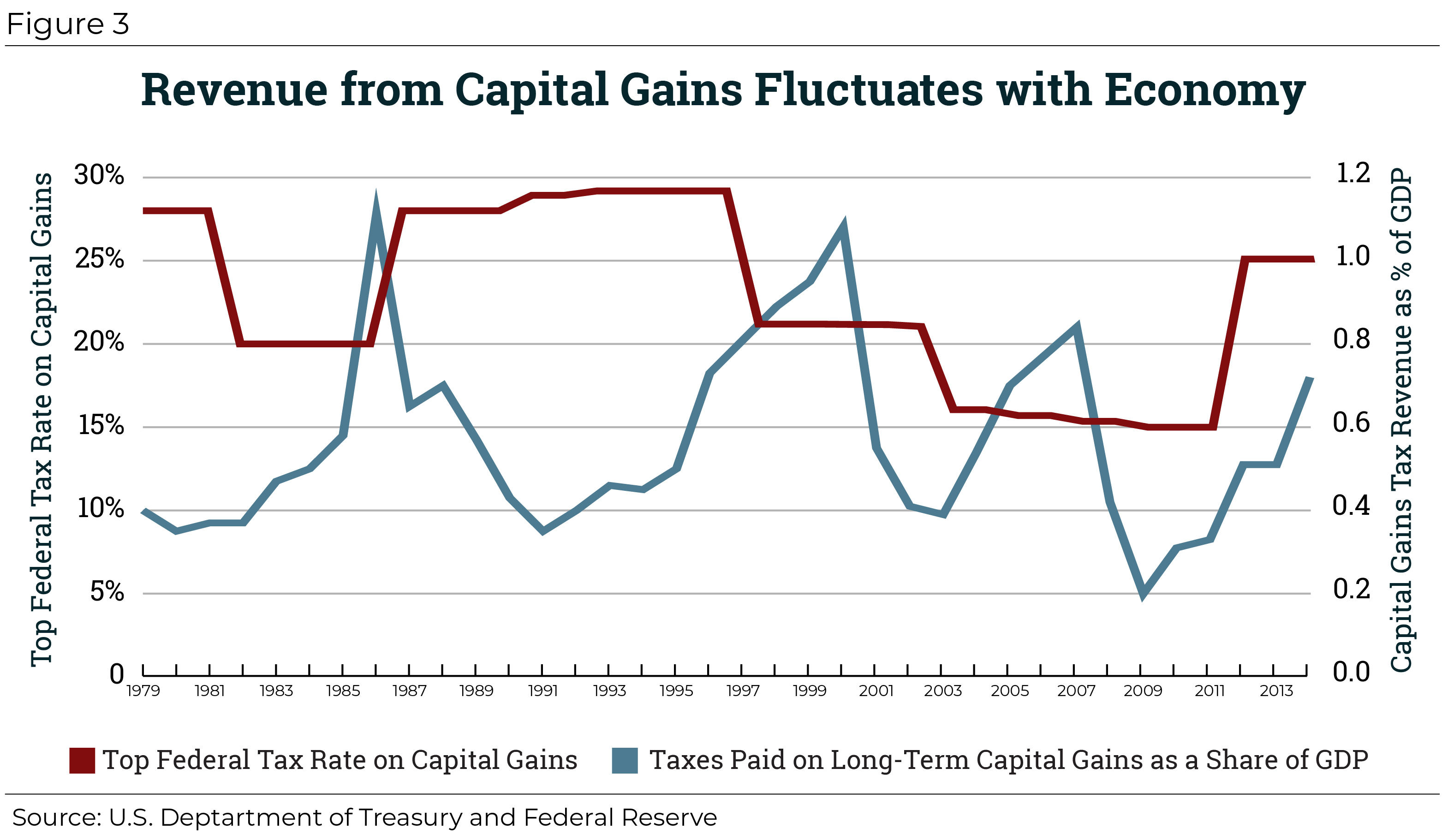

For example in both 2018 and 2022 long-term capital gains of 100000 had a tax rate of 93 but the total. The capital gains tax is based on that profit. Capital gains tax rates on most assets held for a year or less correspond to.

The 5000 purchase price of the stock represents your cost basis. The capital gains tax rate in Ontario for the highest income bracket is 2676. Individuals and families must pay the following capital gains taxes.

It imposes an additional 38 tax on your investment income including your capital gains if your modified adjusted gross income MAGI is greater than. Instead the criteria that dictates how much tax you pay has changed over the years. Any money earned from investments will be.

Special real estate exemptions for capital gains. The two year residency test need not be. You do not have to pay capital gains tax until youve sold.

You sell your entire position for 6500 producing a 1500 gain on sale. Theres a limit to the amount of capital gains that qualify for the 0 rate. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

Capital gains are the profits you make when you sell a stock real estate or other taxable asset that increased in value while you owned it. Choose from a Wide Variety of Tax-Free Exchange Forms.

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Article What Is The Capital Gain Tax What Is The Capital Gain Tax

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Capital Gains Tax What Is It When Do You Pay It

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Income Types Not Subject To Social Security Tax Earn More Efficiently

Short Term Capital Gains Tax What It Is How To Calculate Seeking Alpha

How Do Short Term Capital Gains Work Vs Long Term Capital Gains Quora

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

Capital Gains Tax In Kentucky What You Need To Know

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

How High Are Capital Gains Taxes In Your State Tax Foundation